When you want to rent a house or an apartment, you must fill out a rental application. This is a very important step. One thing you may see on this form is a credit reference. But what is a credit reference? Why is it important? Let’s find out.

Understanding Credit References

A credit reference is a report about your credit history. It shows how you have paid your bills in the past. Landlords want to know if you can pay rent on time. They want to see if you are responsible.

Your credit reference can come from different sources. It can be a bank, a credit card company, or a credit reporting agency. This report helps landlords make a decision. They want to rent to someone who will pay rent every month.

Why Do Landlords Ask for a Credit Reference?

Landlords use credit references for several reasons:

- To Check Your Payment History: They want to see if you pay bills on time.

- To Assess Your Financial Responsibility: They want to know how you handle money.

- To Reduce Risk: They want to avoid renting to someone who may not pay.

All these reasons help landlords choose the right tenant. A good credit reference can make you look like a good renter.

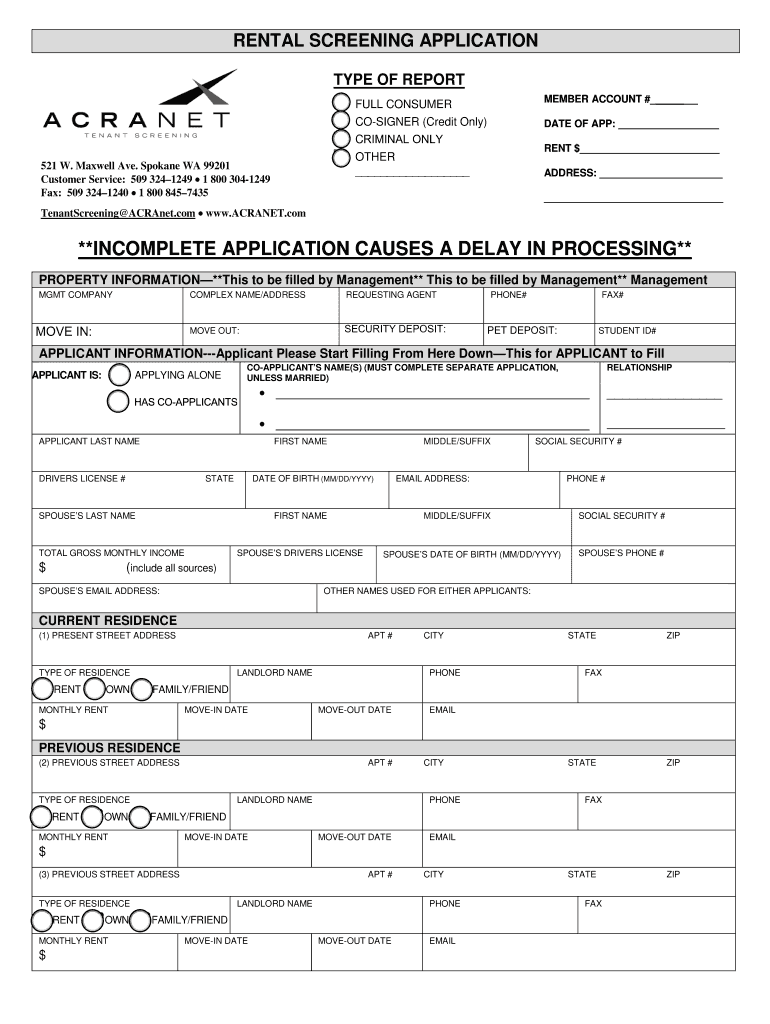

Credit: credit-information-application.pdffiller.com

What Does a Credit Reference Include?

A credit reference typically includes:

- Your Name: This helps to identify you.

- Your Address: This shows where you live.

- Your Credit Score: This is a number that shows your credit health.

- Payment History: This shows how you have paid your bills.

- Debt Information: This shows how much money you owe.

Each part of the report helps the landlord learn more about you. They can see if you are a good candidate for renting.

How to Get a Credit Reference

You can get a credit reference in a few easy steps:

- Check Your Credit Score: You can get this from credit agencies.

- Request a Report: You can ask for your credit report.

- Review the Report: Look for mistakes and correct them.

This way, you will know what landlords see about you. You can prepare for your rental application.

What If You Have Bad Credit?

Sometimes, people have bad credit. This can make it hard to rent a place. But there are still options:

- Provide a Co-Signer: This is someone who agrees to pay if you cannot.

- Show Proof of Income: This can show you can pay rent.

- Offer a Larger Deposit: This can make landlords feel safer.

These options can help you get approved for a rental.

How Does a Bad Credit Reference Affect Your Application?

A bad credit reference can hurt your chances. Landlords may worry about your ability to pay. This can lead to rejection. However, not all landlords are the same. Some may be willing to work with you. It depends on their policies.

Credit: www.avail.co

Tips for Improving Your Credit Reference

If you want to improve your credit reference, here are some tips:

- Pay Bills on Time: Always pay your bills when they are due.

- Reduce Debt: Try to pay off your credit cards and loans.

- Check Your Credit Report: Look for errors and fix them.

By following these tips, you can improve your credit score. A better score can help you in the future.

Conclusion

A credit reference is an important part of a rental application. It shows your credit history and payment habits. Landlords use it to decide if they want to rent to you. If you have good credit, you have a better chance of getting the place you want.

Remember, if you have bad credit, there are ways to improve it. Take steps to show that you are responsible. This will help you in your search for a rental home. Good luck!

Leave a Review