Checks are a common way to pay for things. They can be very helpful. But sometimes, you may need to stop a check. This can happen for many reasons. Maybe you lost the check or had a problem with a payment. But what happens if a stop payment check is cashed? This article explains what you need to know.

What is a Stop Payment?

A stop payment is a request to cancel a check. This means that the bank will not let the check go through. You can ask for a stop payment for many reasons:

- You lost the check.

- The check was stolen.

- You made a mistake when writing the check.

- You had a disagreement with the person you paid.

When you ask for a stop payment, the bank puts a hold on the check. This hold can stop the check from being paid. However, there are some important things to know.

How to Place a Stop Payment

Placing a stop payment is usually easy. Here are the steps to do it:

- Contact your bank. You can call or visit.

- Provide details of the check. Include the check number and amount.

- Pay any fees. Some banks charge for this service.

After you make the request, the bank will act quickly. They will put a stop on the check. But remember, this does not guarantee that the check will not be cashed.

What Happens If the Check is Cashed?

Sometimes, a stop payment does not work. If the check is cashed after you placed a stop payment, here is what happens:

1. The Bank May Still Process The Check

Even with a stop payment, the bank may still process the check. This can happen if the check was cashed before the bank received your request. The check may go through because of timing issues.

2. You May Lose Money

If the check is cashed, your account will be charged. This means you may lose the money you wanted to protect. Your bank may not be able to help you get it back.

3. You Can Dispute The Transaction

If you see that a check was cashed, you can dispute it. To dispute a transaction, follow these steps:

- Contact your bank right away.

- Provide proof of the stop payment request.

- Ask the bank to investigate.

Keep in mind that disputes take time. The bank may need to review records and check details. This can be frustrating, but it is necessary.

The Importance of Keeping Records

Keeping good records is very important. This helps you if something goes wrong. Always keep copies of your checks. Write down when you requested a stop payment. This can help you in case of a dispute.

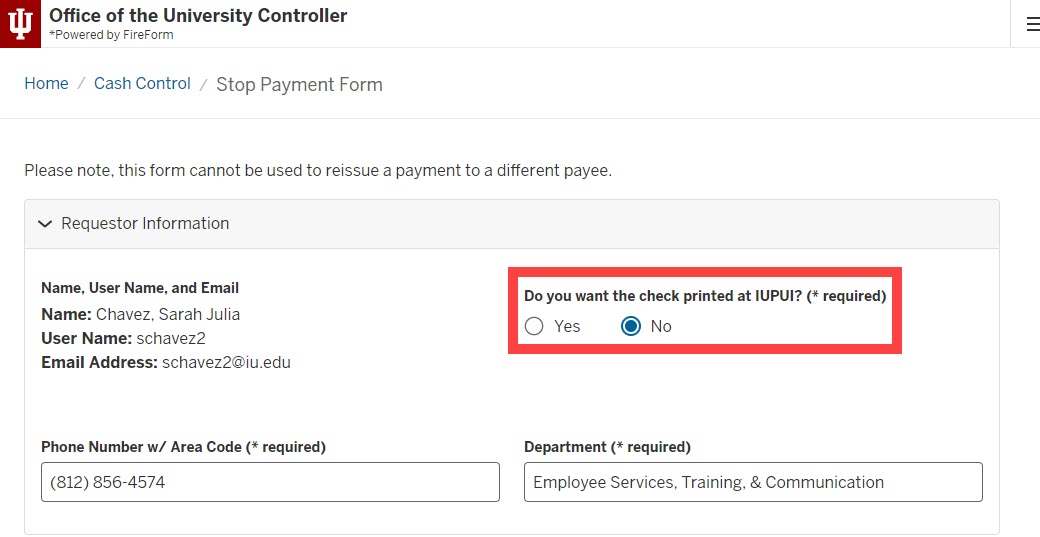

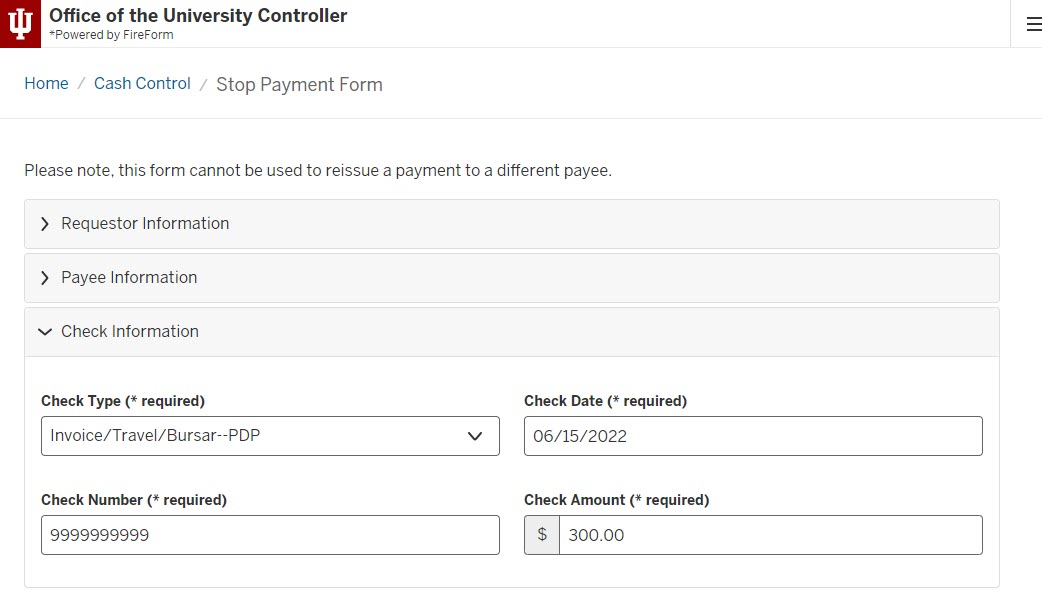

Credit: training.iu.edu

Understanding Your Rights

As a customer, you have rights. If a stop payment fails, you can ask your bank for help. They should explain why the check was cashed. It is important to know your rights as a consumer.

What to Do If a Stop Payment Fails

If your stop payment fails, here are some actions you can take:

- Contact the person you wrote the check to. Explain the situation.

- Ask them to return the money if possible.

- Monitor your bank account for any changes.

- Consider placing a fraud alert if necessary.

Preventing Issues with Checks

To avoid problems with checks, consider these tips:

- Use electronic payments when possible. They are safer.

- Keep track of all checks you write.

- Always double-check the details before sending a check.

- Notify your bank of any lost or stolen checks right away.

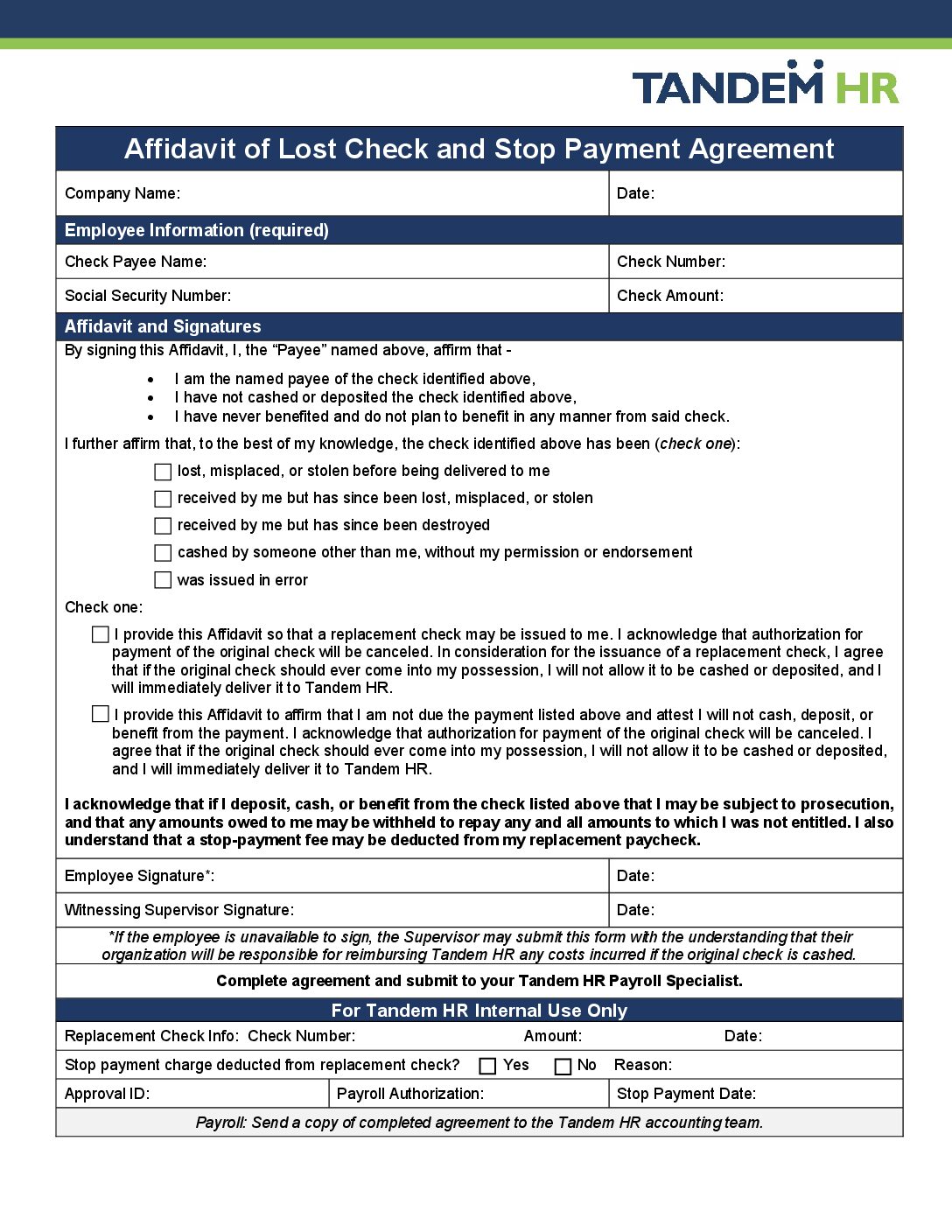

Credit: tandemhr.com

Conclusion

A stop payment check can help protect your money. But it is not foolproof. If a stop payment fails, the bank may still process the check. This can lead to losing money and needing to dispute the transaction. Always keep good records and understand your rights as a consumer.

If you have further questions, contact your bank. They can provide information and help you with your situation.

Leave a Review