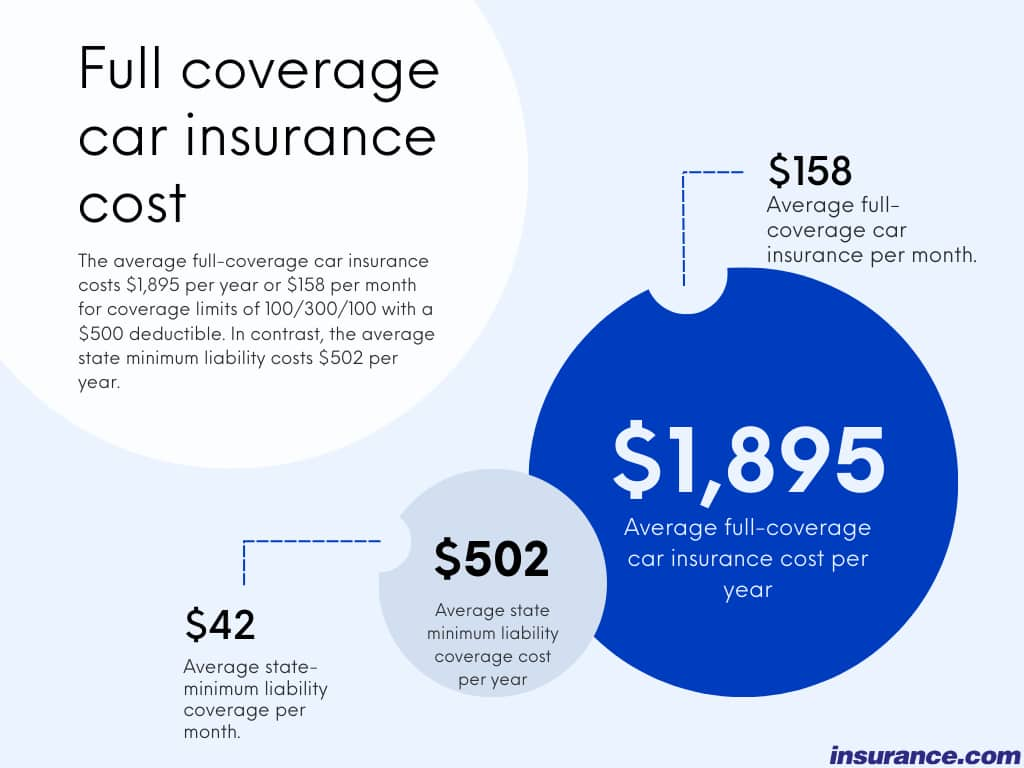

Finding the right car insurance can be hard. Many people want full coverage. But they also want low costs. This article will help you understand low-cost full coverage car insurance.

What is Full Coverage Car Insurance?

Full coverage car insurance means you have many types of protection. It usually includes:

- Liability coverage

- Collision coverage

- Comprehensive coverage

Liability coverage pays for damage you cause to others. Collision coverage pays for damage to your car in an accident. Comprehensive coverage helps if your car is stolen or damaged by nature.

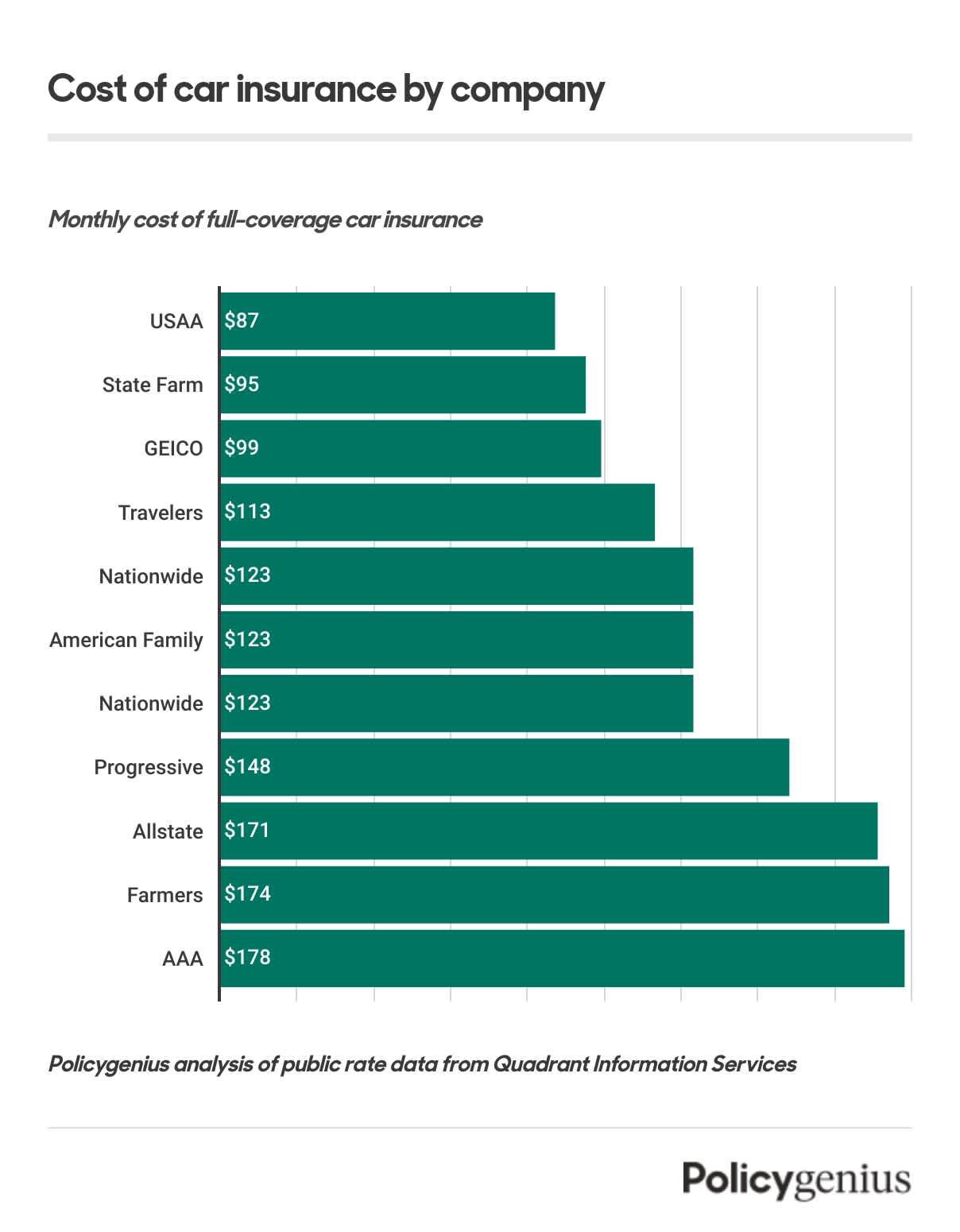

Credit: www.policygenius.com

Why Choose Full Coverage?

Full coverage gives you peace of mind. You know your car and finances are protected. This is important, especially if you have a new car. Repair costs can be very high.

It also helps if you cause an accident. You won’t have to pay for all the damages yourself. This can save you money in the long run.

Finding Low-Cost Full Coverage Car Insurance

Many people think full coverage costs a lot. But there are ways to find low-cost options. Here are some tips to help you:

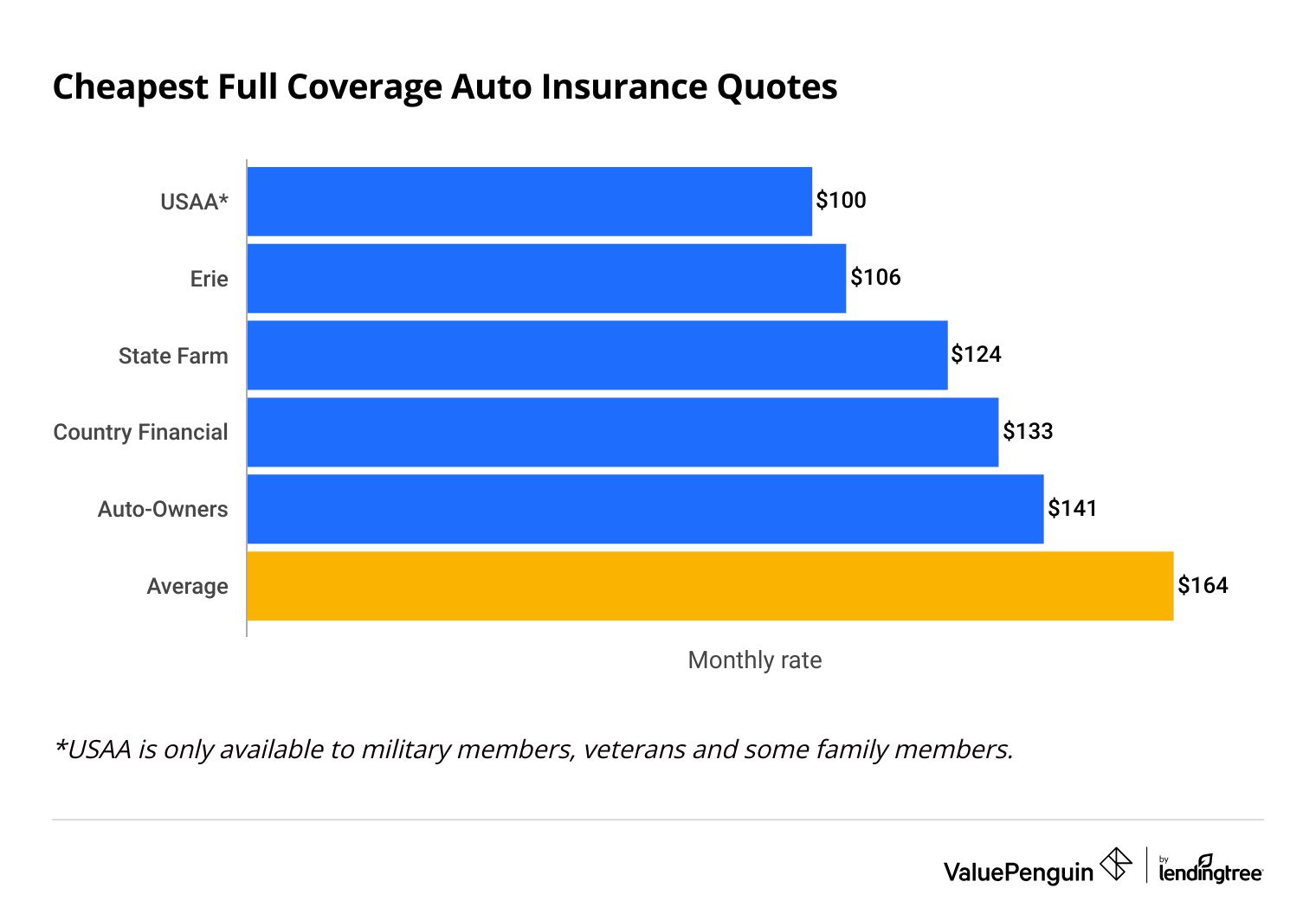

1. Shop Around

Don’t settle for the first quote. Get quotes from different companies. Each company has different rates. Some may offer better deals for you.

2. Compare Coverage Options

Not all full coverage is the same. Some policies include extras. Others may not. Make sure you compare what each policy offers.

3. Raise Your Deductible

A deductible is the amount you pay before insurance kicks in. If you raise your deductible, your monthly payment may go down. But remember, you will pay more if you have an accident.

4. Look For Discounts

Many insurance companies offer discounts. You might get a discount for:

- Safe driving

- Bundling policies

- Being a good student

Ask your insurance agent about discounts. You may be surprised by how much you can save.

5. Check Your Credit Score

Your credit score can affect your rates. A higher score often means lower rates. Pay your bills on time. Keep your credit card balances low. This can help improve your score.

6. Consider Your Car

The type of car you drive matters. Some cars are more expensive to insure. Sports cars and luxury cars usually cost more. Choose a car that is cheaper to insure.

Factors Affecting Insurance Costs

Many factors can affect how much you pay for insurance. Here are some key points:

1. Your Age

Young drivers often pay more. This is because they have less experience. Older drivers usually pay less.

2. Your Driving Record

If you have accidents or tickets, you may pay more. A clean driving record can help lower your rates.

3. Location

Where you live matters. Some areas have more accidents or thefts. If you live in a high-risk area, expect to pay more.

4. Mileage

How much you drive affects your cost. If you drive a lot, your risk increases. Less driving can mean lower rates.

How to Save on Full Coverage Car Insurance

Saving money on insurance is important. Here are some more ways to save:

1. Pay In Full

If you can, pay your premium in full. Some companies offer discounts for this. It can save you money over time.

2. Take A Defensive Driving Course

Some companies give discounts for taking a driving course. This shows you are a safe driver. It may help lower your rates.

3. Limit Coverage On Older Cars

If your car is old, you may not need full coverage. Consider dropping collision or comprehensive coverage. This can save you money.

4. Review Your Policy Regularly

Life changes can affect your insurance needs. Review your policy every year. Make sure you have the right coverage. Adjust as needed to save money.

Credit: www.valuepenguin.com

Conclusion

Low-cost full coverage car insurance is possible. It may take some time and effort. But it is worth it. You can protect yourself and your car without spending too much.

Remember to shop around. Compare different options. Look for discounts and save where you can. With the right approach, you can find a good insurance policy.

Frequently Asked Questions (FAQs)

1. Can I Get Full Coverage For A Low Price?

Yes, with the right research and discounts, you can.

2. How Often Should I Review My Insurance Policy?

It’s good to review your policy every year.

3. What Is The Difference Between Liability And Full Coverage?

Liability covers damage you cause to others. Full coverage protects your own car too.

4. Are There Discounts For Safe Driving?

Yes, many companies offer discounts for safe driving records.

5. Is It Worth It To Get Full Coverage For An Old Car?

It depends on the value of the car. Older cars may not need full coverage.

Take Action Today

Now that you know more, take action. Start shopping for low-cost full coverage car insurance. Use the tips in this article. You can find a policy that fits your needs and budget.

Leave a Review