Finding affordable car insurance in Georgia is important. Many people need car insurance. It protects you and your car. It helps pay for damages and injuries. In Georgia, many options exist. This guide will help you understand low-cost car insurance. We will discuss how to find it and what to consider.

Why You Need Car Insurance

Car insurance is a legal requirement in Georgia. All drivers must have it. Here are some reasons why car insurance is important:

- Legal Protection: It is the law in Georgia.

- Financial Protection: It helps pay for accidents.

- Peace of Mind: You feel safer when driving.

- Protection for Others: It covers damages to others.

Types of Car Insurance in Georgia

There are different types of car insurance. Knowing these types helps you choose the right one. Here are the main types:

- Liability Insurance: This is the basic type. It covers damages to others if you cause an accident.

- Collision Insurance: It helps pay for damages to your car after an accident.

- Comprehensive Insurance: This covers non-collision damages. For example, theft or natural disasters.

- Uninsured Motorist Coverage: This protects you if someone without insurance hits you.

How to Find Low-Cost Car Insurance in Georgia

Finding low-cost car insurance can take time. Here are some steps to help you:

1. Compare Rates

Look at different insurance companies. Each company offers different rates. You can use websites to compare them easily.

2. Consider Your Coverage Needs

Think about how much coverage you need. Some people need more coverage than others. If you have an older car, you might need less coverage.

3. Check For Discounts

Many companies offer discounts. You might qualify for a discount if you:

- Have a good driving record.

- Are a good student.

- Bundle multiple policies.

- Have safety features in your car.

4. Increase Your Deductible

A deductible is what you pay before insurance kicks in. If you choose a higher deductible, your premium may be lower. But remember, you must pay this amount first.

5. Maintain A Good Credit Score

Your credit score can affect your rates. Companies often check it. A better score can lead to lower premiums.

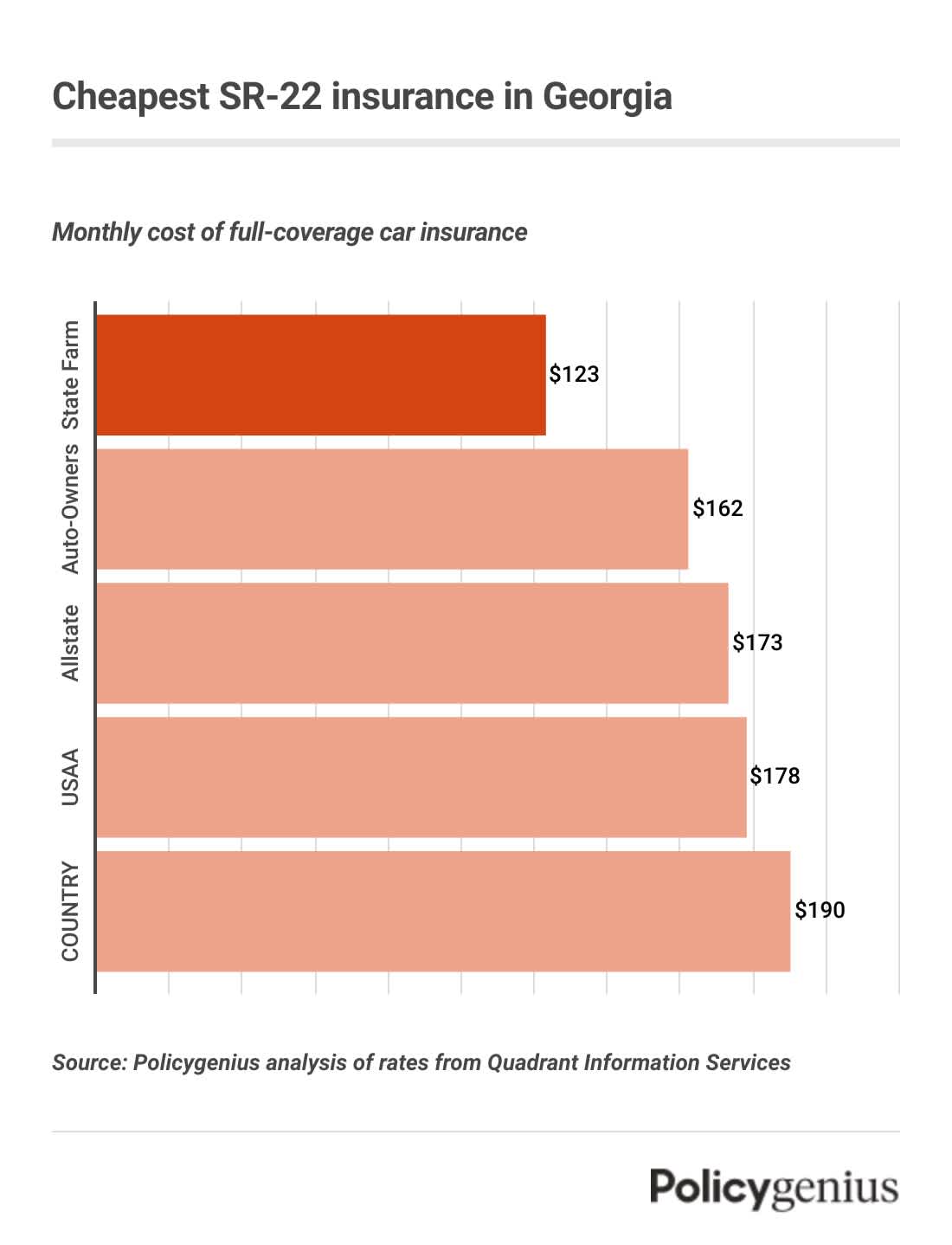

Average Cost of Car Insurance in Georgia

The average cost of car insurance in Georgia varies. Several factors influence this cost. Here are some averages:

| Type of Coverage | Average Monthly Cost |

|---|---|

| Liability Only | $70 |

| Full Coverage | $150 |

| Minimum Coverage | $50 |

Credit: www.policygenius.com

Factors That Affect Your Insurance Rates

Many factors can change your insurance rates. Here are some common ones:

- Age: Younger drivers often pay more.

- Location: Urban areas may have higher rates.

- Driving History: A clean record usually helps.

- Type of Car: Some cars cost more to insure.

Tips for Lowering Your Car Insurance Costs

Want to save money? Here are some helpful tips:

- Review your policy regularly.

- Take a defensive driving course.

- Limit claims to avoid rate increases.

- Drive safely and avoid accidents.

- Consider usage-based insurance programs.

Finding the Right Insurance Company

Choosing the right insurance company is crucial. Look for companies with good customer service. Read reviews to learn more. Here are some well-known companies in Georgia:

- State Farm

- GEICO

- Progressive

- Allstate

Credit: wallethub.com

Conclusion

Finding low-cost car insurance in Georgia is possible. Start by comparing rates. Understand what coverage you need. Look for discounts and increase your deductible. Keep your driving record clean. All these steps can help you save money. Remember, the right insurance protects you and your car. Drive safe and stay insured!

Leave a Review