The contribution margin ratio is important for businesses. It helps them understand profits. This article explains what the contribution margin ratio is. We will also show you how to calculate it step by step.

What is Contribution Margin?

First, let’s define contribution margin. The contribution margin shows how much money is left. This is after covering the variable costs of a product. Variable costs change with the number of items made. For example, if a company makes toys, the material cost is a variable cost. More toys mean more material costs.

Why is Contribution Margin Important?

Understanding contribution margin helps businesses in many ways:

- It helps to set prices.

- It shows how many products to sell.

- It helps to analyze costs.

- It helps in planning for profits.

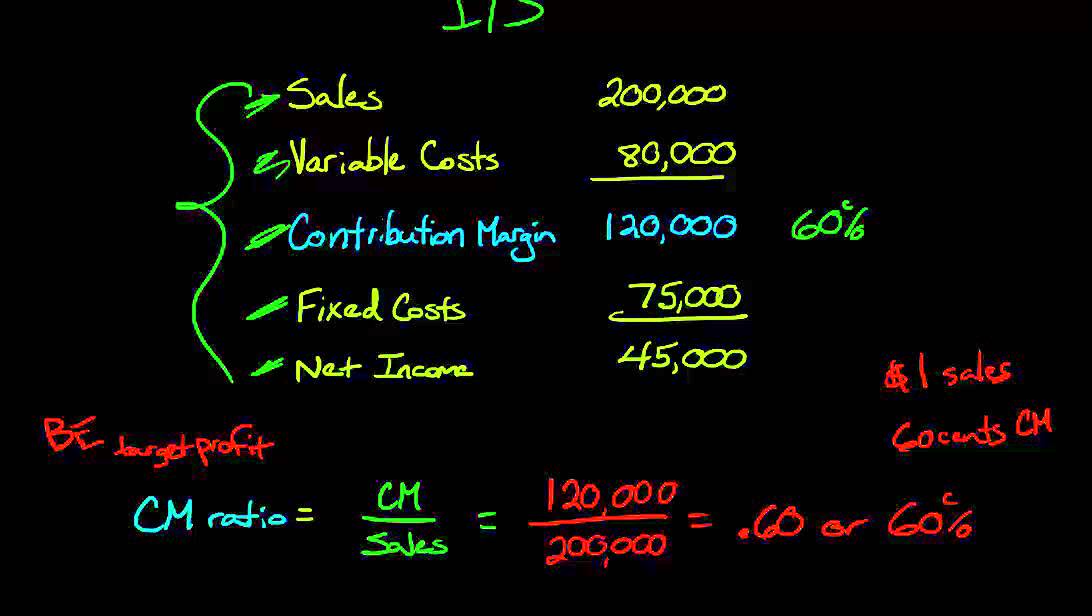

Credit: www.youtube.com

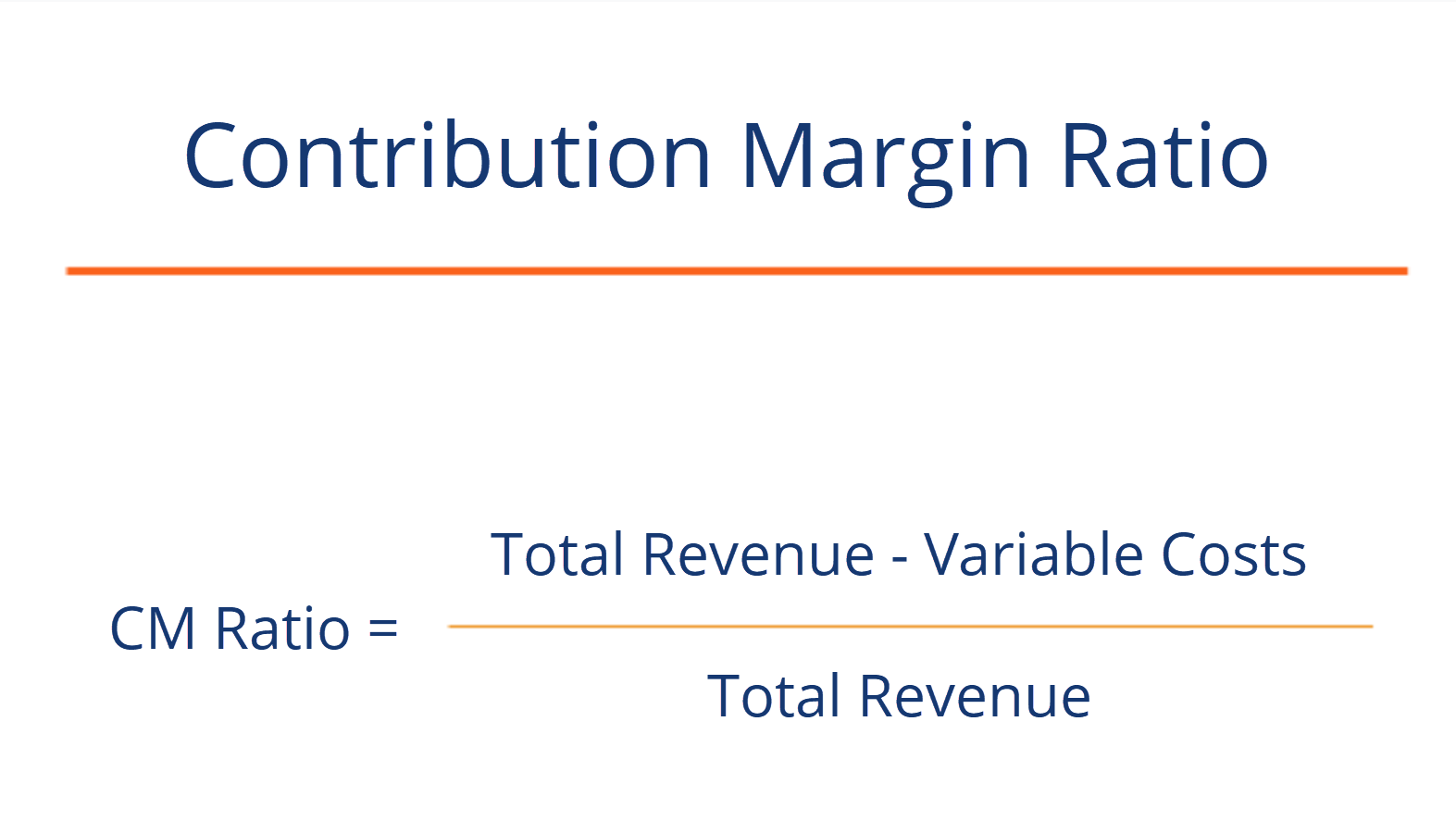

What is Contribution Margin Ratio?

The contribution margin ratio is a simple formula. It shows the percentage of sales that covers fixed costs. Fixed costs do not change with production. Examples include rent and salaries.

How to Calculate Contribution Margin Ratio

Step 1: Know Your Sales Revenue

First, you need to know your sales revenue. This is the total money from sales. For example, if you sell 100 toys for $10 each, your sales revenue is:

Sales Revenue = Price per Unit × Number of Units Sold

Sales Revenue = $10 × 100 = $1,000

Step 2: Know Your Variable Costs

Next, find out the variable costs. Variable costs can be materials, labor, and shipping. If the cost to make one toy is $6, then:

If you made 100 toys, the total variable costs are:

Total Variable Costs = Variable Cost per Unit × Number of Units Sold

Total Variable Costs = $6 × 100 = $600

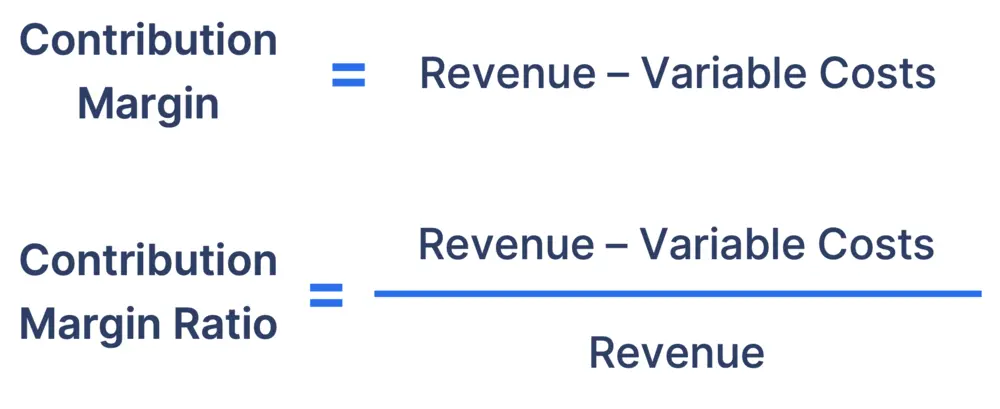

Step 3: Calculate Contribution Margin

Now, we can calculate the contribution margin. This shows how much money is left after variable costs. The formula is:

Contribution Margin = Sales Revenue – Total Variable Costs

Contribution Margin = $1,000 – $600 = $400

Step 4: Calculate Contribution Margin Ratio

Finally, we find the contribution margin ratio. The formula is:

Contribution Margin Ratio = Contribution Margin ÷ Sales Revenue

Contribution Margin Ratio = $400 ÷ $1,000 = 0.4

To get a percentage, multiply by 100:

Contribution Margin Ratio = 0.4 × 100 = 40%

Example Calculation

Let’s do another example. Imagine you sell lemonade. You sell each cup for $2. You sell 200 cups. Your sales revenue is:

Sales Revenue = $2 × 200 = $400

Your variable costs are $1 per cup. So, total variable costs are:

Total Variable Costs = $1 × 200 = $200

Your contribution margin is:

Contribution Margin = $400 – $200 = $200

Now, calculate the contribution margin ratio:

Contribution Margin Ratio = $200 ÷ $400 = 0.5

Convert to a percentage:

Contribution Margin Ratio = 0.5 × 100 = 50%

Using Contribution Margin Ratio

Now that you know how to calculate the contribution margin ratio, how can you use it?

Here are some ways:

- Help set prices for products.

- Decide which products to sell more of.

- Determine how many products need to be sold to cover costs.

- Analyze changes in costs and sales.

Credit: corporatefinanceinstitute.com

Conclusion

In summary, the contribution margin ratio is very useful. It shows how much money is left after paying variable costs. This helps businesses make important decisions. By following the steps outlined, you can calculate the contribution margin ratio easily.

Understanding this ratio can help you plan for future profits. Use it to understand your business better. Thank you for reading this guide on how to calculate the contribution margin ratio!

Leave a Review