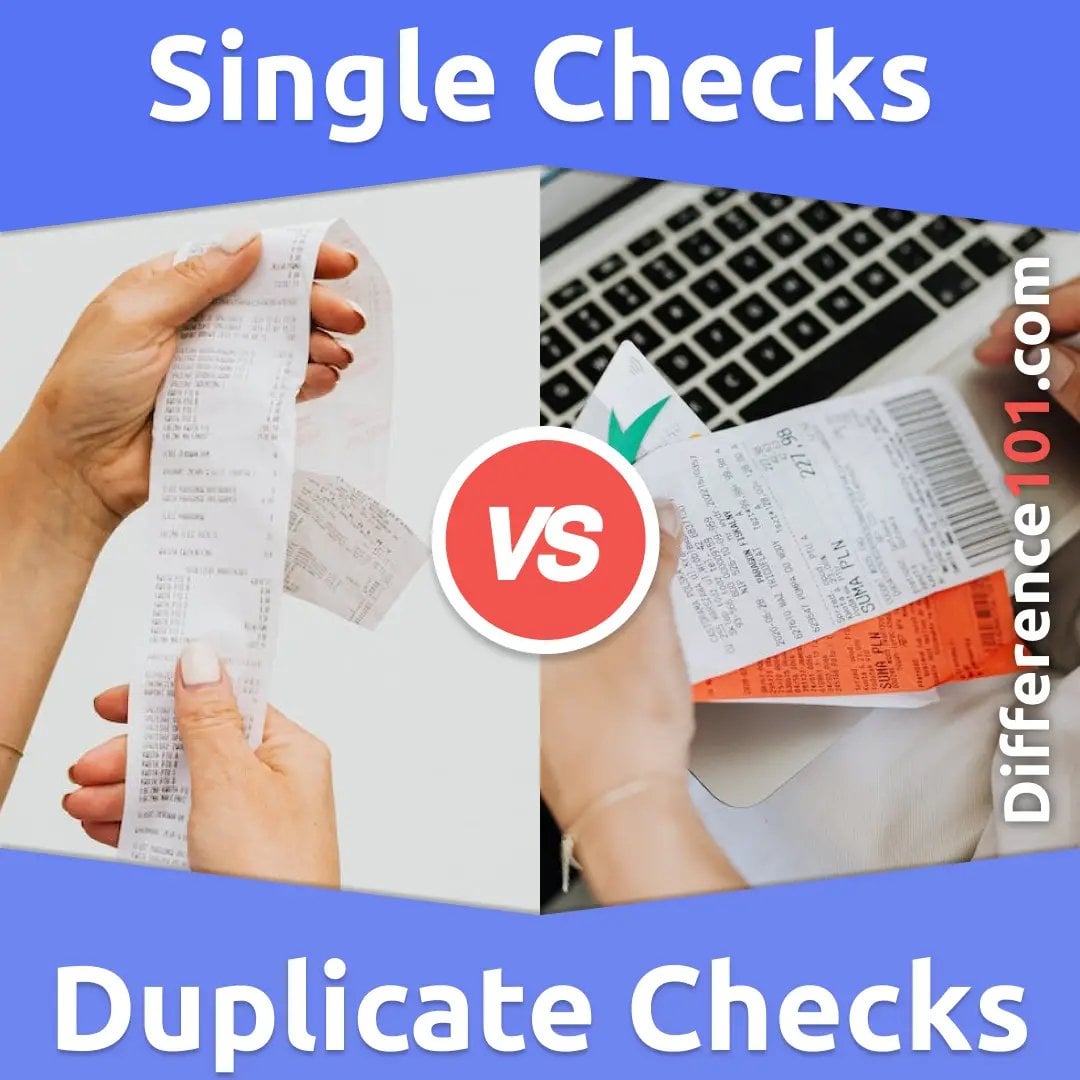

Checks are important tools in banking and finance. They help people pay for things without cash. There are different types of checks. Two common types are single checks and duplicate checks. In this article, we will explore these two types. We will explain what they are and how they differ. Understanding these differences is important for everyone.

Credit: www.youtube.com

What is a Single Check?

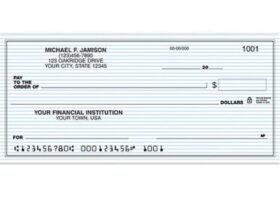

A single check is a regular check. It has one copy. When a person writes a single check, they fill out the check with the date, amount, and payee’s name. The check is then handed to the person or business. Once the check is cashed or deposited, it is no longer valid. It cannot be used again.

Features Of Single Checks

- One copy only

- Used for one transaction

- Simple to write

- Commonly used for everyday payments

What is a Duplicate Check?

A duplicate check is different. It has two copies. When a person writes a duplicate check, they keep one copy for themselves. The other copy goes to the payee. This is helpful for record-keeping. The person can track their spending better with a duplicate check.

Features Of Duplicate Checks

- Two copies available

- Good for record-keeping

- Helps track payments

- More useful for businesses

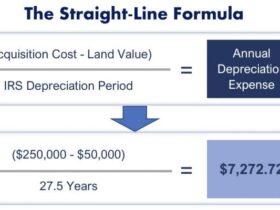

Key Differences between Single Checks and Duplicate Checks

1. Number Of Copies

The main difference is the number of copies. A single check has one copy. A duplicate check has two copies. This feature makes each type useful in different ways.

2. Usage

Single checks are best for simple payments. They are used for everyday expenses. Duplicate checks are better for business transactions. They help keep track of spending.

3. Record Keeping

With a single check, you do not have a record. Once you give it away, it is gone. Duplicate checks give you a copy. This helps you remember what you spent.

4. Cost

Single checks usually cost less. They are simpler to produce. Duplicate checks may cost more. This is because they have an extra copy. However, this cost can be worth it for better tracking.

5. Security

Single checks have less security. If lost, you may not have proof of payment. Duplicate checks offer more security. You have a copy in case something happens.

Credit: www.supermoney.com

When to Use Single Checks

Single checks are great for personal use. They are simple and easy to write. Use single checks for:

- Paying rent

- Paying bills

- Giving money to friends

- Buying gifts

When to Use Duplicate Checks

Duplicate checks are useful for businesses. They help track money spent. Use duplicate checks for:

- Paying suppliers

- Employee salaries

- Business expenses

- Invoices

Conclusion

In summary, single checks and duplicate checks serve different needs. Single checks are simple and easy. They are good for personal use. Duplicate checks offer more features. They help with record-keeping. Choose the type that fits your needs. Understanding the differences will help you use checks wisely. Whether you are an individual or a business, using the right check is important.

FAQs

1. Can I Use A Single Check For Business Purposes?

Yes, you can use a single check for business. However, it may not help with tracking.

2. Are Duplicate Checks More Expensive?

Yes, duplicate checks can cost more than single checks. They have an extra copy.

3. What Should I Do If I Lose A Check?

If you lose a check, contact your bank. They can help you cancel it.

4. Can I Write A Single Check To A Business?

Yes, you can write a single check to a business. Just fill it out like normal.

5. How Do I Order Checks?

You can order checks through your bank. You can also order them online.

Final Thoughts

Understanding checks helps in managing money. Knowing the difference between single and duplicate checks is helpful. Choose wisely based on your needs. This knowledge will make your financial life easier.

Leave a Review