Finding cheap car insurance in California can be hard. Many people want to save money. But they also want good coverage. This article helps you understand how to find affordable car insurance. We will discuss tips, types of coverage, and more.

Why is Car Insurance Important?

Car insurance is important for many reasons. First, it protects you from big costs. If you have an accident, repairs can be expensive. Insurance helps cover these costs. Second, it is required by law in California. You must have insurance to drive legally.

What Is Minimum Coverage?

California requires minimum coverage. This means you need to have some insurance. The minimum coverage includes:

- Liability coverage for injury or death.

- Liability coverage for property damage.

- Uninsured motorist coverage.

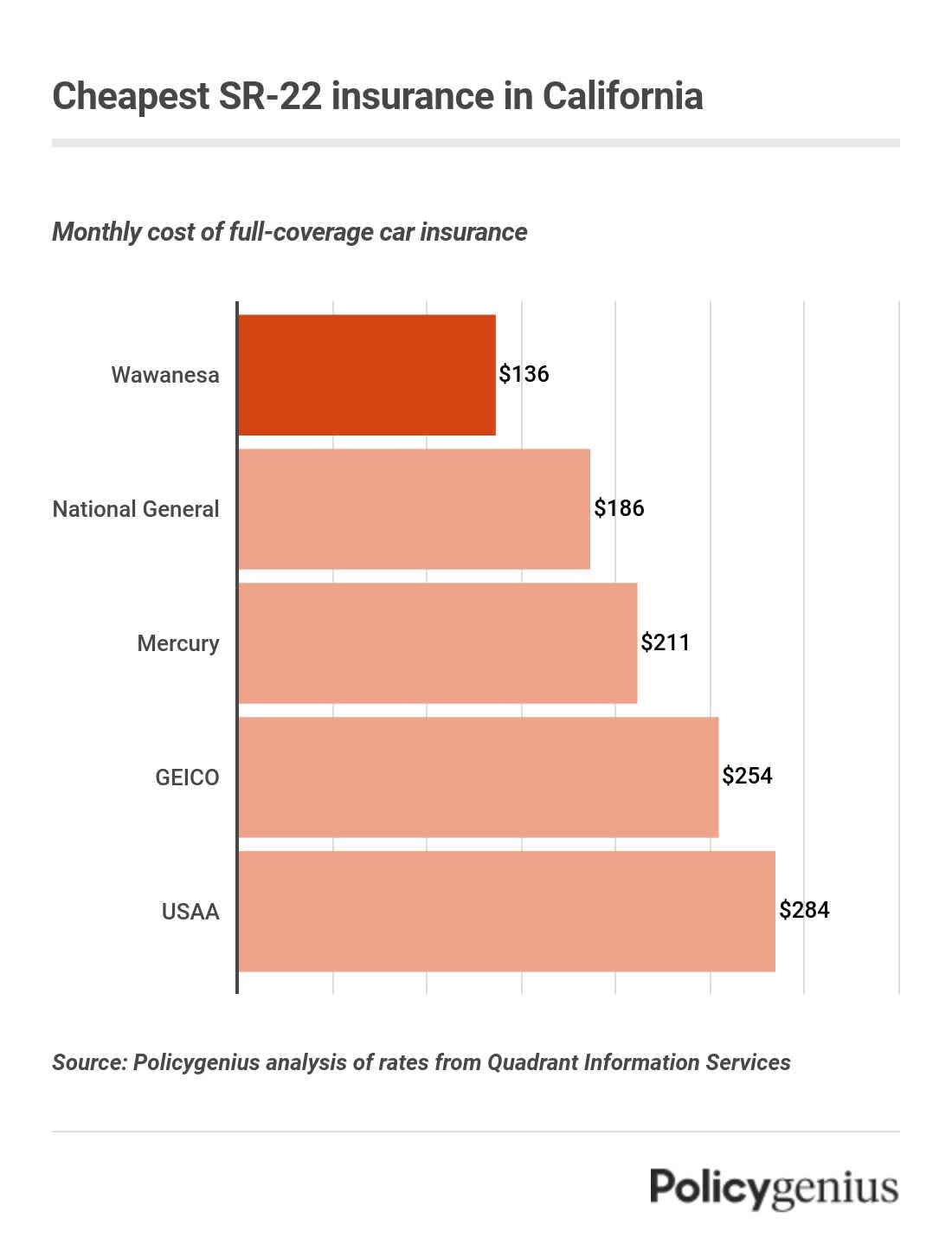

Credit: www.policygenius.com

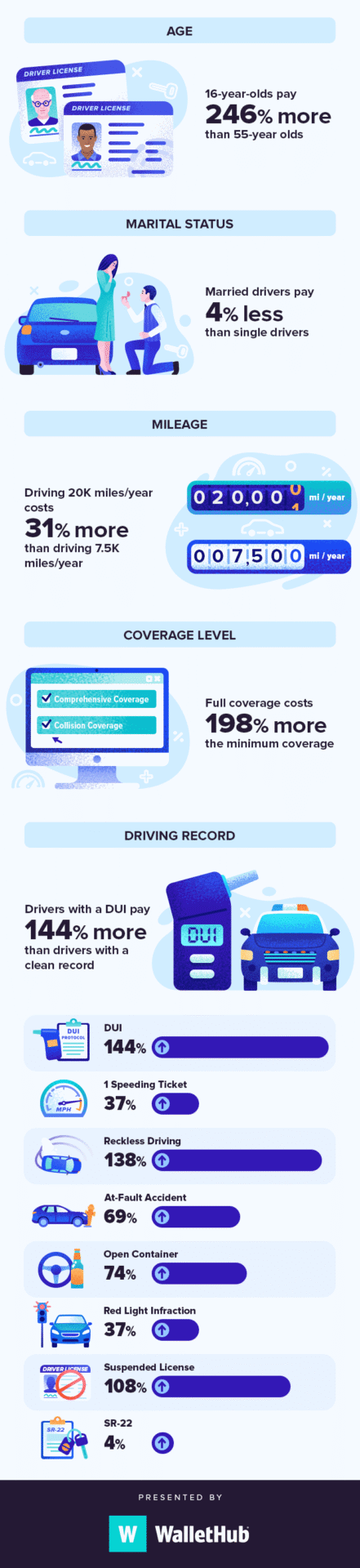

Credit: wallethub.com

How to Find Cheap Car Insurance

There are many ways to find cheap car insurance in California. Here are some helpful tips:

1. Compare Quotes

One of the best ways to save money is to compare quotes. Different companies offer different prices. You can use websites to compare rates quickly. Make sure to check at least three different companies. This will help you find the best deal.

2. Look For Discounts

Many insurance companies offer discounts. These can lower your insurance cost. Here are some common discounts:

- Good driver discount for safe driving.

- Multi-policy discount for bundling insurance.

- Low mileage discount if you drive less.

- Student discount for good students.

3. Increase Your Deductible

A deductible is the amount you pay before insurance helps. If you choose a higher deductible, your monthly payment may be lower. This can save you money. But make sure you can afford the deductible if you have an accident.

4. Maintain A Good Credit Score

Your credit score can affect your insurance rate. A good credit score can help you get cheaper insurance. Pay your bills on time. Avoid taking on too much debt. This will help improve your credit score.

5. Choose The Right Vehicle

The type of car you drive matters. Some cars are cheaper to insure. Sports cars and luxury cars often cost more. Research different vehicles before you buy. Choose a car that is safe and affordable to insure.

Types of Car Insurance Coverage

There are different types of car insurance coverage. Understanding these can help you decide what you need.

1. Liability Coverage

This is the minimum coverage required by law. It helps pay for injuries and damages you cause to others. It does not cover your own injuries.

2. Collision Coverage

Collision coverage helps pay for damage to your car. This is useful if you hit another car or object. It can help you repair or replace your car.

3. Comprehensive Coverage

Comprehensive coverage protects against non-collision events. This includes theft, vandalism, or natural disasters. It helps pay for damages caused by things other than accidents.

4. Personal Injury Protection (pip)

PIP helps cover medical costs for you and your passengers. It pays for medical bills, lost wages, and other costs. This coverage is not required in California, but it can be useful.

5. Uninsured/underinsured Motorist Coverage

This coverage helps if you are hit by someone without insurance. It also helps if the other driver has too little insurance. This can protect you from high costs.

How to Save on California Car Insurance

Saving money on car insurance is possible. Here are more ways to lower your costs:

1. Take A Defensive Driving Course

Some insurance companies offer discounts for completing a driving course. This shows you are a safe driver. It can help lower your insurance rates.

2. Limit Your Coverage On Older Cars

If your car is old, you may not need full coverage. Consider dropping collision or comprehensive coverage. This can save you money. But make sure your car is worth it.

3. Drive Less

If you drive less, you may qualify for a low mileage discount. Try to carpool or use public transport. This can help reduce your insurance rates.

4. Review Your Policy Annually

Insurance needs change over time. Review your policy each year. Make sure you have the best coverage for your needs. Look for ways to save money.

Common Questions About Car Insurance

1. What Happens If I Drive Without Insurance?

Driving without insurance can lead to big fines. You may also lose your driving license. It is important to have at least the minimum coverage.

2. Can I Change My Insurance Anytime?

Yes, you can change your insurance at any time. Just make sure you have new coverage before canceling the old one.

3. How Do I File A Claim?

To file a claim, contact your insurance company. They will ask for details about the accident. Provide all necessary information to get help.

Conclusion

Finding cheap car insurance in California is possible. Use these tips to save money. Remember to compare quotes and look for discounts. Choose the right coverage for your needs. Keeping your costs down is important. You can drive safely and affordably.

Understanding car insurance can help you make smart choices. Stay informed and be a safe driver. This way, you can protect yourself and save money.

Leave a Review