Managing your credit card payments can be tricky. Many people wonder, “How much should I pay my credit card each month?” This article will help you understand credit card payments. It will also guide you on making the right decisions.

Understanding Credit Cards

Credit cards are tools for spending money. They let you buy things even if you do not have cash. You borrow money from the bank. Later, you pay it back.

When you use a credit card, you need to pay attention. Each month, you get a bill. This bill shows how much you owe. It also shows how much you need to pay to avoid interest.

Minimum Payment

The minimum payment is the least amount you can pay. It is usually a small percentage of your total balance. You can find this number on your bill. It is important to know this amount.

However, paying only the minimum can be risky. It means you will carry a balance. This can lead to high interest charges. Over time, this can cost you a lot of money.

Paying More Than the Minimum

To save money, try to pay more than the minimum. If you can, pay the full balance. This will help you avoid interest charges. Paying in full is the best option.

Here are some benefits of paying more:

- You save money on interest.

- You improve your credit score.

- You pay off debt faster.

Credit: www.thebalancemoney.com

How Much Should You Pay?

Now, let’s answer the big question. How much should you pay each month?

It depends on your situation. Here are some tips to help you decide:

1. Pay The Full Balance

If you can, pay the full balance. This is the best choice. It keeps you from paying interest. It also helps your credit score.

2. Pay More Than The Minimum

If you cannot pay the full balance, pay more than the minimum. This reduces your debt faster. It also cuts down on interest costs.

3. Create A Budget

Make a budget to see how much you can pay. Look at your income and expenses. This will help you find money to pay your credit card.

4. Set Up Automatic Payments

Consider setting up automatic payments. This means the bank takes money from your account each month. It helps you pay on time. You can choose to pay the full balance or a fixed amount.

Credit: www.self.inc

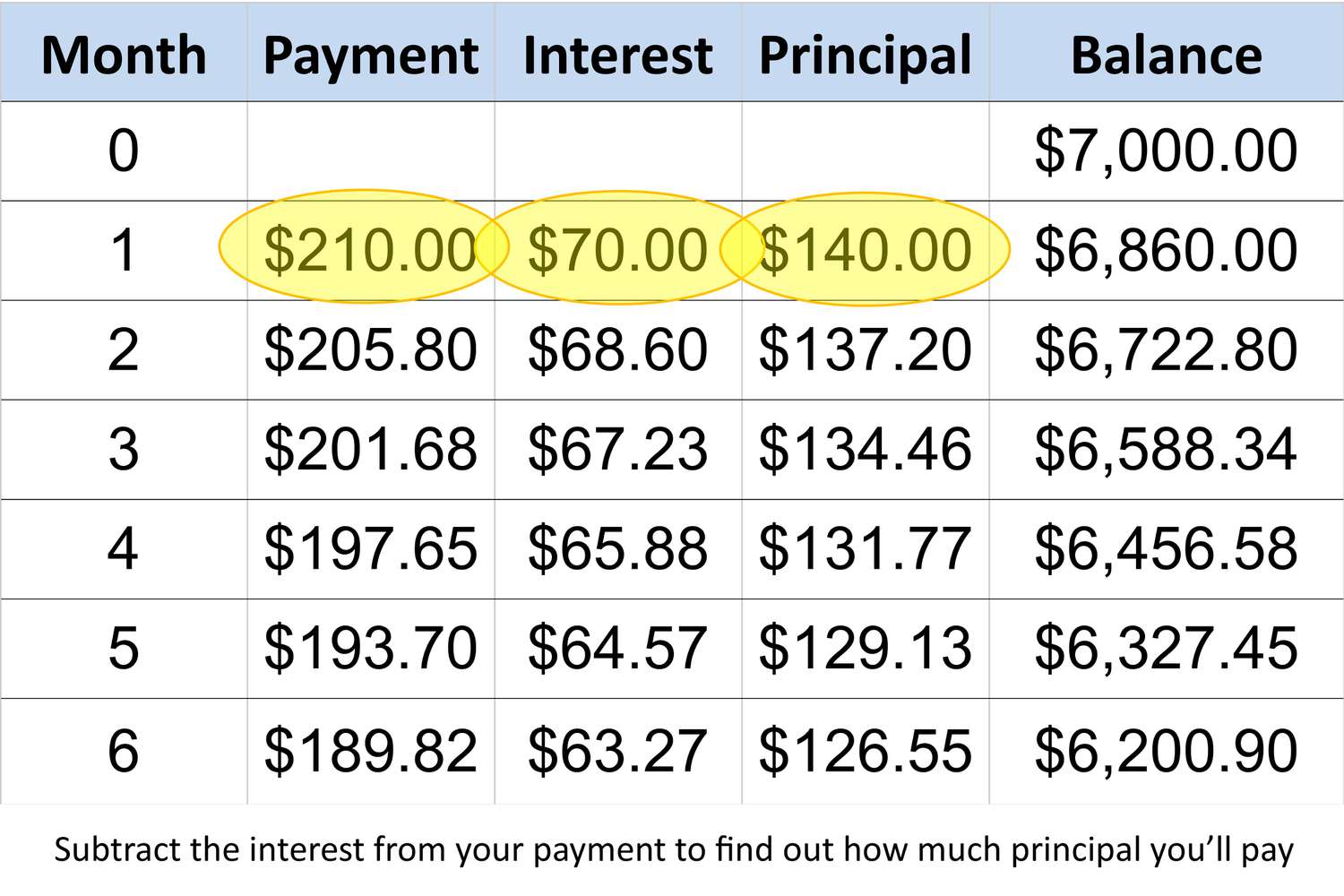

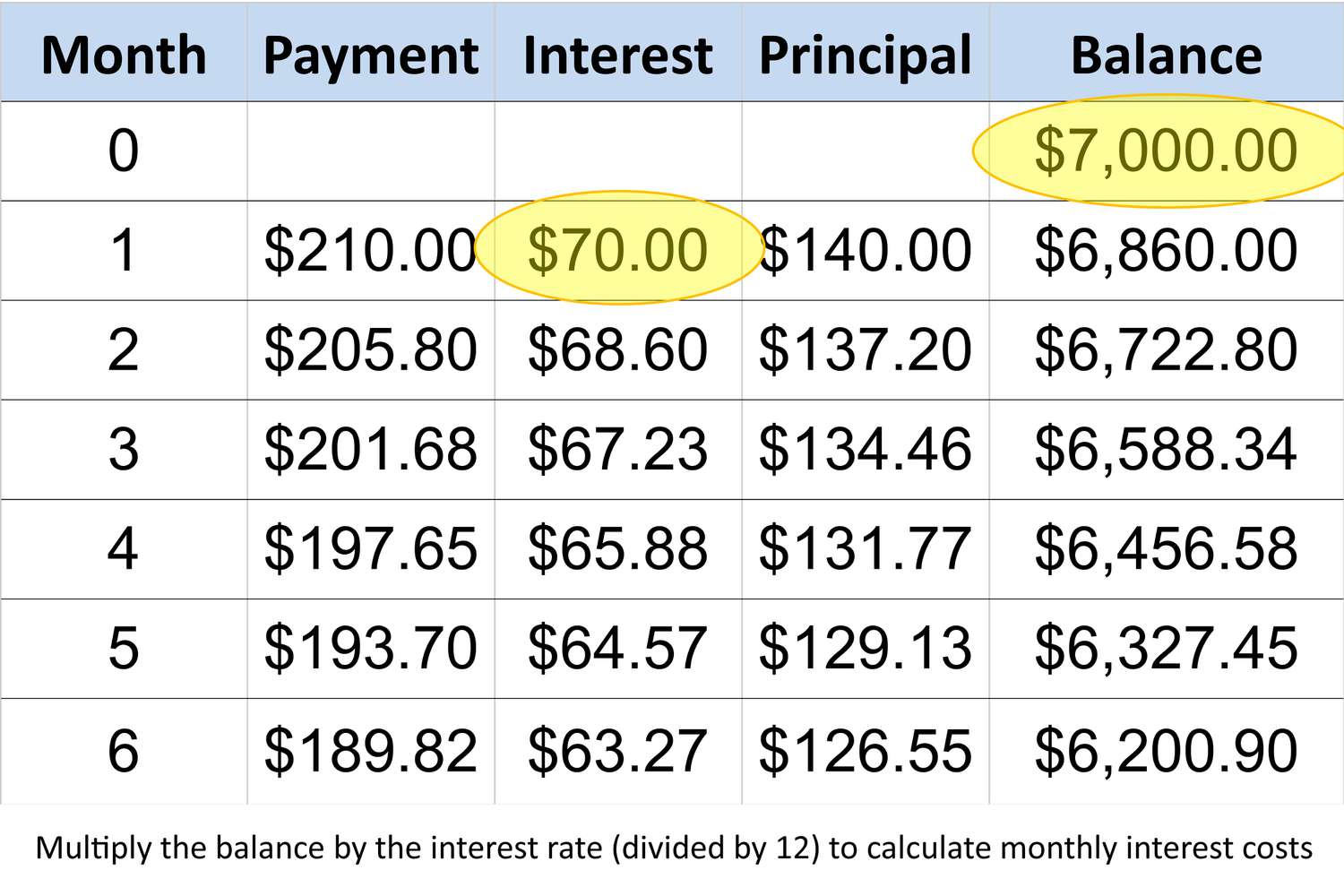

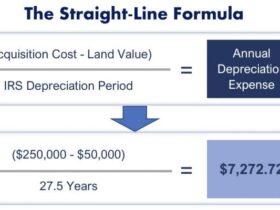

Example of Credit Card Payments

Let’s look at an example. Imagine you have a credit card balance of $1,000. Your minimum payment is $25.

If you only pay $25 each month:

- You will take a long time to pay off the debt.

- You will pay a lot of interest.

If you pay $100 each month:

- You will pay off the debt faster.

- You will save money on interest.

Paying on Time

Always pay on time. Late payments can hurt your credit score. They can also lead to late fees. Set reminders to help you remember.

Impact on Credit Score

Your credit score is important. It shows how well you manage money. Paying your credit card on time helps your score. It also shows lenders you are responsible.

What Happens If You Don’t Pay?

Not paying your credit card can lead to problems. You may face late fees. Your interest rate may increase. In time, this can cause serious financial issues.

Conclusion

Deciding how much to pay your credit card each month is important. Always try to pay the full balance. If you cannot, pay more than the minimum. Create a budget to help you manage your money.

Remember to pay on time. This helps your credit score. It also keeps you from paying extra fees. Following these tips will keep your finances healthy.

Final Tips

Here are some final tips for managing your credit card payments:

- Check your statement each month.

- Look for unauthorized charges.

- Contact your bank if you see anything strange.

- Keep track of your spending.

- Use your credit card wisely.

By following these guidelines, you can manage your credit card better. Stay informed about your payments. Make smart choices with your money.

Leave a Review