Understanding federal tax withholding is very important. Many people ask, “What percent should I withhold?” This question is common. It is also very important for your financial health. This article will explain everything you need to know.

Credit: quickbooks.intuit.com

What is Federal Tax Withholding?

Federal tax withholding is the money taken from your paycheck. This money goes to the federal government. The government uses this money for many things. These include roads, schools, and the military. Withholding helps you pay your taxes. It prevents you from having a big tax bill at the end of the year.

Why is Withholding Important?

Withholding is important for a few reasons:

- It helps you pay your taxes on time.

- It can prevent large tax bills in April.

- It can help you avoid penalties and interest.

How Much Should You Withhold?

Many people wonder how much to withhold. The answer can depend on a few things:

- Your income level.

- Your filing status.

- Your number of dependents.

Most people use a percent of their paycheck. This percent can be different for everyone.

Checking Your Paycheck

Your paycheck will show how much is withheld. Look for the line that says “Federal Tax.” This line shows how much money is taken out. It is usually a percentage of your total pay.

Using the IRS Withholding Calculator

The IRS provides a tool for you. This is called the IRS Withholding Calculator. You can find it on the IRS website. This tool helps you decide how much to withhold. It asks questions about your income and family. Then, it gives you a recommendation.

Filing Status

Your filing status matters. There are four main types of filing status:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

Each status has different tax rates. Married couples may withhold less money than singles.

Dependents

Dependents are people you support financially. This can be children or other relatives. The more dependents you have, the less you may need to withhold. Each dependent can reduce your taxable income.

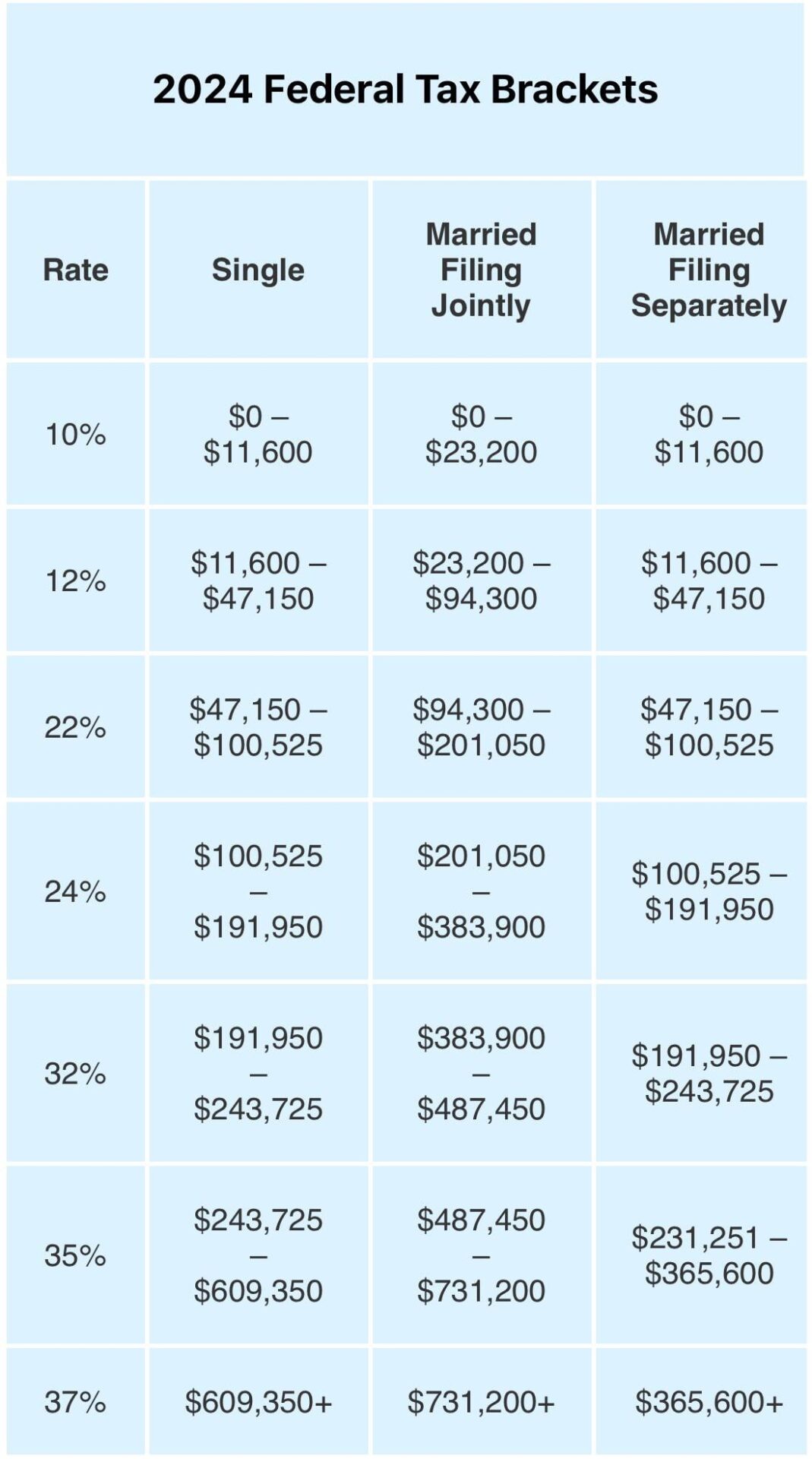

Tax Brackets

The federal government uses tax brackets. These are ranges of income that are taxed at different rates. Here are the current tax brackets:

| Income Range | Tax Rate |

|---|---|

| $0 – $10,275 | 10% |

| $10,276 – $41,775 | 12% |

| $41,776 – $89,075 | 22% |

| $89,076 – $170,050 | 24% |

| $170,051 – $215,950 | 32% |

| $215,951 – $539,900 | 35% |

| Over $539,901 | 37% |

These brackets change every year. They can also change with new laws.

Adjusting Your Withholding

Sometimes, you may need to adjust your withholding. This can happen for many reasons:

- You started a new job.

- You got married or divorced.

- You had a baby.

- Your income changed.

If you need to adjust, fill out a new W-4 form. You can get this form from your employer.

Credit: www.reddit.com

W-4 Form Explained

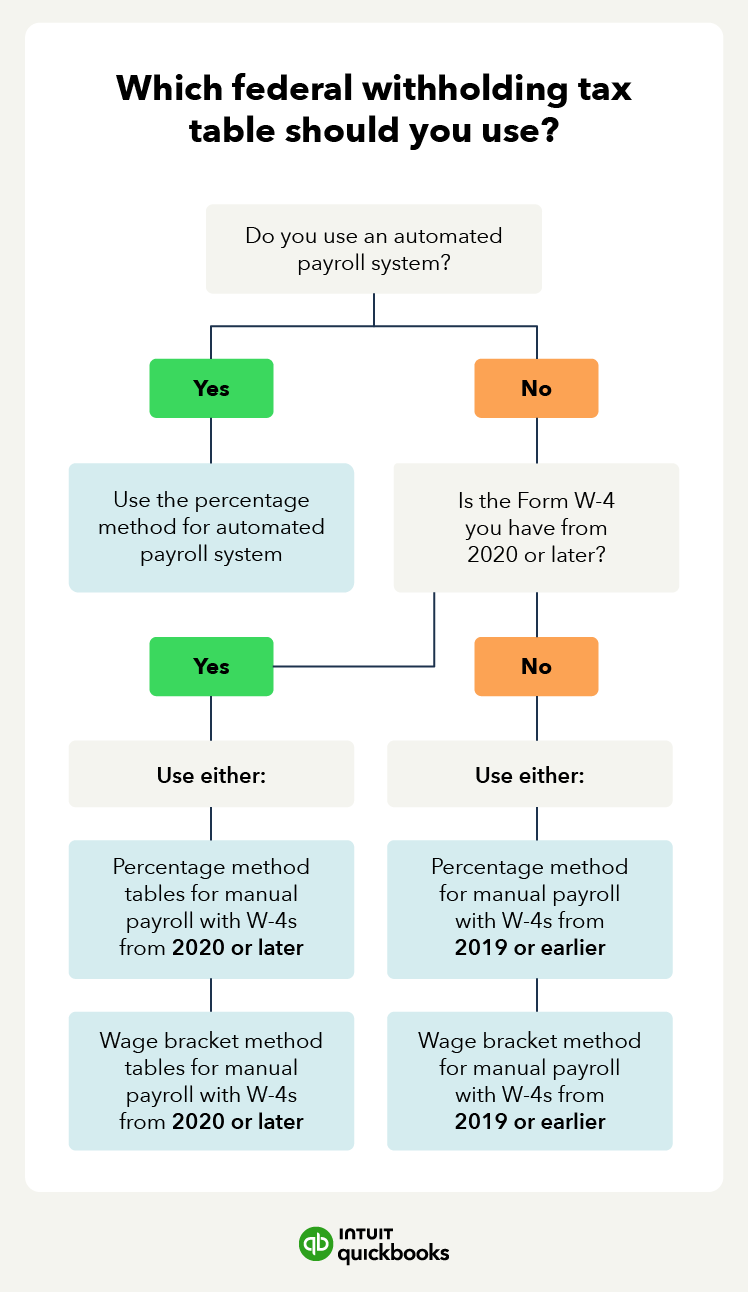

The W-4 form helps your employer know how much to withhold. It asks for your personal information. This includes your name, address, and Social Security number. It also asks about your filing status and dependents.

Make sure to fill it out carefully. This form will affect your paychecks.

Common Mistakes

Many people make mistakes with withholding. Here are some common ones:

- Not checking their withholding every year.

- Not updating their W-4 after life changes.

- Assuming withholding is correct without checking.

Avoid these mistakes. Check your withholding often.

When to Review Your Withholding

It is a good idea to review your withholding every year. Do this after you file your taxes. Also, review it when your life changes. Changes include marriage, divorce, or having a child. These events can affect how much you should withhold.

How to Change Your Withholding

To change your withholding, follow these steps:

- Obtain a W-4 form from your employer or the IRS website.

- Fill it out with your new information.

- Submit the form to your employer.

- Check your next paycheck to see the changes.

Conclusion

Withholding for federal taxes is important. It helps you manage your money. Knowing what percent to withhold can save you money.

Use tools like the IRS Withholding Calculator. Always review your withholding every year. Make changes when your life changes. This way, you can avoid surprises at tax time.

Understanding taxes can seem hard. But with the right information, you can do it. Take control of your finances today!

Leave a Review