Calculating depreciation on a rental property can be tricky. But, it is very important for owners. Depreciation helps in understanding how much value your property loses over time. This can also help in tax savings. Let us explore this topic in detail.

What is Depreciation?

Depreciation is a way to measure value loss. When a property is used, it can lose value. Many reasons cause this loss. For example, wear and tear from tenants. Or changes in the market. Depreciation is important for rental property owners. It helps in tax calculations.

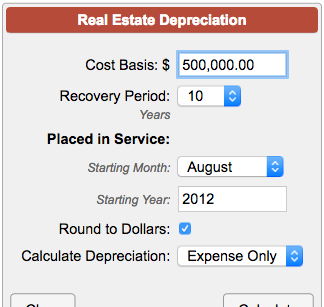

Credit: www.calculatorsoup.com

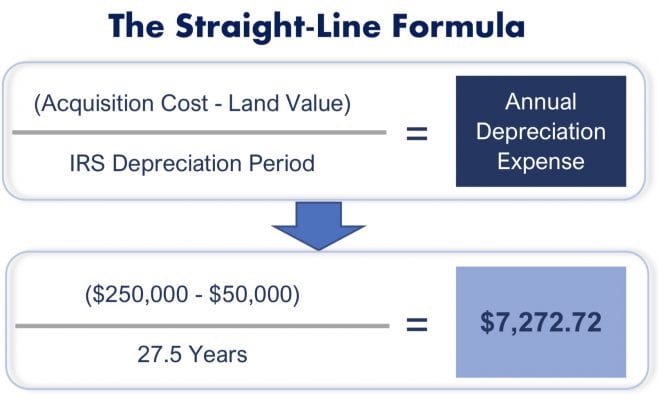

Credit: www.stessa.com

Why is Depreciation Important?

Depreciation is important for several reasons:

- It reduces taxable income.

- It shows the real value of the property.

- It helps in budgeting for repairs.

Understanding depreciation can save money. This is important for every rental property owner.

Types of Depreciation Methods

There are different ways to calculate depreciation. The most common methods include:

- Straight-Line Method

- Declining Balance Method

- Units of Production Method

Let us look at each method closely.

Straight-line Method

This is the simplest way to calculate depreciation. You take the cost of the property. Then, you divide it by the number of years it will last. This gives you a steady amount each year. It is easy to understand.

Here is the formula:

Annual Depreciation = (Cost of Property – Salvage Value) / Useful Life

Salvage value is what you expect to sell it for later. Useful life is how many years the property will last.

Declining Balance Method

This method gives a larger deduction in the early years. It decreases over time. This is useful if you think your property will lose value quickly. The formula is more complex.

Here is the basic formula:

Annual Depreciation = Book Value at Beginning of Year x Depreciation Rate

Book value is the original cost minus any previous depreciation. The depreciation rate can vary.

Units Of Production Method

This method is best for properties with a limited life. It depends on how much you use the property. For example, a rental property that is heavily used may lose value faster.

Here is the formula:

Annual Depreciation = (Cost – Salvage Value) x (Units Used / Total Estimated Units)

This method is less common for rental properties. However, it can be useful in some cases.

How to Calculate Depreciation Step by Step

Here is a simple guide to calculate depreciation:

Step 1: Determine The Cost Of The Property

The cost of the property includes:

- Purchase price

- Closing costs

- Any repairs made before renting

All these costs add up to the total cost of the property.

Step 2: Determine The Salvage Value

Salvage value is the amount you think you can sell the property for later. This is usually lower than the cost. It is your best guess.

Step 3: Determine The Useful Life

Useful life is how long you expect the property to last. For residential rental properties, it is usually 27.5 years. For commercial properties, it is 39 years.

Step 4: Choose A Depreciation Method

Choose a method that fits your needs. Many people use the straight-line method. It is simple and predictable.

Step 5: Calculate Annual Depreciation

Now, use the formula from your chosen method. This will give you the annual depreciation amount.

Example Calculation

Let’s do an example to make it clear:

- Cost of Property: $200,000

- Salvage Value: $20,000

- Useful Life: 27.5 years

Using the straight-line method, the calculation is:

Annual Depreciation = ($200,000 – $20,000) / 27.5

This equals about $6,545 per year.

Every year, you can deduct this amount from your taxes.

Recording Depreciation on Taxes

When you calculate depreciation, you need to record it. This is done on your tax return. You can use IRS Form 4562 for this. It helps track depreciation and other expenses.

Make sure to keep all your records. This includes purchase documents and repair bills. These can help if the IRS has questions.

Common Mistakes to Avoid

When calculating depreciation, avoid these common mistakes:

- Not including all costs.

- Choosing the wrong method.

- Not keeping good records.

These mistakes can lead to lost money. Always double-check your work.

Conclusion

Calculating depreciation on a rental property is important. It helps understand the property’s value. It also helps save on taxes. There are different methods to use. The straight-line method is the easiest.

Follow the steps outlined in this article. This will help you calculate depreciation correctly. Always keep good records. This will help you in the long run.

Now, you are ready to calculate depreciation on your rental property.

Leave a Review