Understanding interest is important. It helps us manage money better. Interest can grow your savings. It can also increase debts. One key term is “compounded daily.” Let’s explore what that means.

What is Interest?

Interest is the extra money you earn or pay. When you save money, banks pay you interest. When you borrow money, you pay interest. There are two main types of interest: simple and compound.

Simple Interest vs. Compound Interest

Simple interest is easy to calculate. You get a fixed amount. It does not change. For example, if you save $100 at 5% interest, you earn $5 each year. After three years, you earn $15.

Compound interest is different. It can grow your money faster. Here’s how it works. Interest is added to your account. Then, you earn interest on the new total. This means your money can grow quicker.

What Does Compounding Mean?

Compounding means adding interest to the principal. The principal is the original amount of money. Each time interest is added, the total grows. The next interest calculation uses this new total. This is how your savings can increase more each year.

Compounded Daily

When interest is compounded daily, it means interest is calculated every day. This is different from other methods. Some banks compound monthly or yearly.

For example, let’s say you have $1,000 in the bank. The bank offers a 5% annual interest rate. If it compounds daily, it will calculate interest every day. Each day, your interest grows a little. At the end of the year, you will have more money than if it was compounded less often.

How To Calculate Daily Compounding

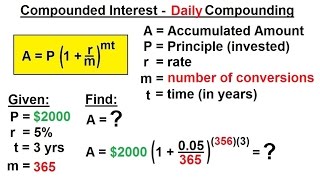

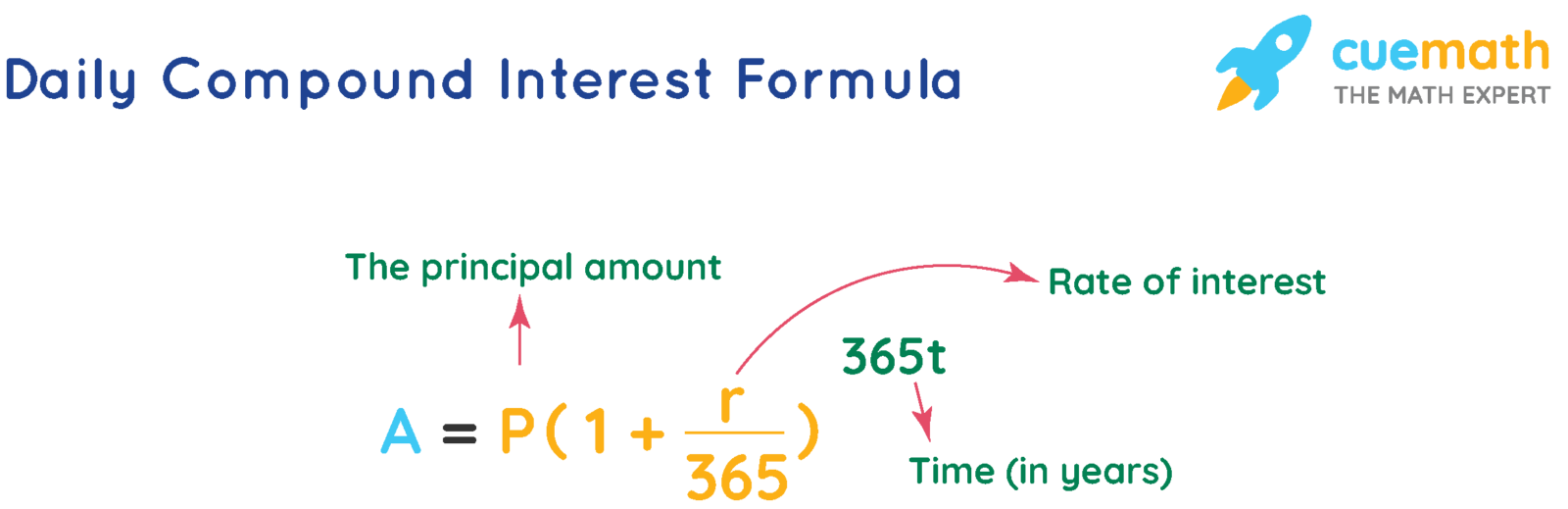

Calculating compound interest can be fun. Here’s a simple formula:

- A = the amount of money accumulated after n years, including interest.

- P = the principal amount (the initial amount).

- r = the annual interest rate (in decimal).

- n = the number of times interest is compounded per year.

- t = the number of years the money is invested or borrowed.

Let’s break it down. If you have $1,000, a 5% interest rate, compounded daily, here’s how it looks:

- P = $1,000

- r = 0.05

- n = 365 (days in a year)

- t = 1 (one year)

Plug the numbers into the formula. You will find out how much money you will have after one year.

The Benefits of Daily Compounding

Daily compounding has many benefits. Here are some of them:

- More Earnings: You earn interest more often.

- Faster Growth: Your money grows faster.

- Better Savings: It helps you save more.

- Encourages Long-Term Saving: The longer you save, the more you earn.

These benefits make daily compounding a good choice for saving. It can help you reach your financial goals more easily.

Examples of Daily Compounding

Let’s look at some examples to understand better. Imagine you save $1,000 at a 5% interest rate.

Example 1: One Year

If you leave the money for one year, you will earn interest every day. By the end of the year, you will have around $1,051.27. That’s about $51.27 in interest.

Example 2: Five Years

If you keep your money for five years, it will grow even more. You will have about $1,283.68. That’s about $283.68 in interest!

Credit: www.youtube.com

Compound Interest in Real Life

Compound interest affects many areas of life. Here are some examples:

- Savings Accounts: Banks use compound interest for savings accounts.

- Loans: When you borrow money, loans may have compound interest.

- Investments: Investments often use compound interest too.

Knowing about compound interest helps you make better choices. You can save more money and understand loans better.

Credit: www.investopedia.com

Risks of Compound Interest

While compound interest can be good, it has risks. Here are some things to watch out for:

- High-Interest Loans: Some loans have high compound interest rates.

- Debt Growth: If you borrow too much, debt can grow fast.

- Fees: Some accounts may have fees that reduce your earnings.

Always read the terms before borrowing or investing. Be sure you understand how much you will pay or earn.

How to Make the Most of Daily Compounding

To benefit from daily compounding, follow these tips:

- Start Saving Early: The sooner you start, the more you earn.

- Choose the Right Account: Look for accounts with high interest rates.

- Avoid Withdrawals: Leave your money to grow.

- Keep Learning: Stay informed about interest and savings.

These steps can help you make the most of your money.

Conclusion

Understanding daily compounding is important for saving money. It helps your money grow faster. This growth is due to earning interest on interest.

Always consider where you put your money. Choose accounts wisely. Start saving early and avoid unnecessary fees. With time, you can enjoy the benefits of compound interest.

Now you know what it means when interest is compounded daily. You can make better financial choices. This knowledge can help you in the future.

Leave a Review